This article was revised in July 2021 to include the most updated information.

Table of Contents

- What Is Cryptocurrency?

- Getting Started and Purchasing Your First Bitcoin, Ethereum, or Litecoin In Coinbase

- Alternative Ways To Buy Cryptocurrency With USD

- Exchanges

- Sending And Receiving Your Cryptocurrency

- Storing Your Cryptocurrency

- Security

- Doing Your Research

- Mining

- Terminology You Should Know

- Tips

Disclaimer: This is not financial advice. This is a guide to help people out on getting started with crypto and should not be misconstrued as me giving you advice on how to spend or invest your money. Also, note that there are some links included in this article in which I may be able to receive a small commission or incentive. Despite that, I don’t recommend anything I don’t fully endorse or use myself.

Get Free Bitcoin

Sign up through Coinbase using the button below and get $10 USD equivalent of Bitcoin if you spend at least $100 on buying cryptocurrency within 180 days (and I’ll get the same!) It costs you nothing.

Lately, in the world of cryptocurrency, there have been a few camps of people inquiring into it all:

- Many people have heard about Bitcoin in the past and dismissed it as “interesting technology,” but they either didn’t have enough confidence in it at the time or simply forgot about it.

- Following a get-together with family or friends, they learned about the enormous price changes associated with Bitcoin and decided to investigate what all the fuss was about.

- There’s someone in their office whose mood is determined by which coin is gaining or losing traction on any given day, and they want to know what’s going on in their head.

Investing in cryptocurrencies is a way for some people to invest in some amazing and promising technology that will be the future. Others are only motivated by the prospect of making a quick buck.

No matter your motivation for getting started with cryptocurrency, you’ll learn a lot from this article and will be able to easily purchase your first cryptocurrency of choice, learn how to do your research when choosing coins other than those coins offered on Coinbase, and storing your coins properly.

I wanted to make a simple and easy-to-follow guide on getting started. I’m sure you’ve just wondered “How do I get started with cryptocurrency?” Well, without any further ado, here’s the Donovic Media guide on getting started with cryptocurrency.

What Is Cryptocurrency?

Cryptocurrency, simply put, is a type of digital asset that is characterized by secure transactions via cryptography. The first decentralized cryptocurrency, and arguably the most famous, was Bitcoin.

Bitcoin was built on blockchain technology, and its major draw was its decentralization, as opposed to a centralized banking system. This allowed for a certain level of anonymity and security.

Since Bitcoin, many other alternative cryptocurrencies (also known as altcoins) have been created on the blockchain and similar technologies. These alternative cryptocurrencies can serve many functions. For example, there’s Ethereum, which features smart contract functionality.

Phew! So that’s cryptocurrency in a nutshell. There’s much more, but that would be a series of posts on their own.

Getting Started and Purchasing Your First Bitcoin, Ethereum, or Litecoin In Coinbase

The most popular (and by far simplest) place in the United States to buy your first cryptocurrency is Coinbase. Why you ask? They’re a regulated company operating within the United States. (By the way, if you click that link to sign up for your account and spend at least $100 on cryptocurrency within 180 days, you’ll get $10 USD and so will I!)

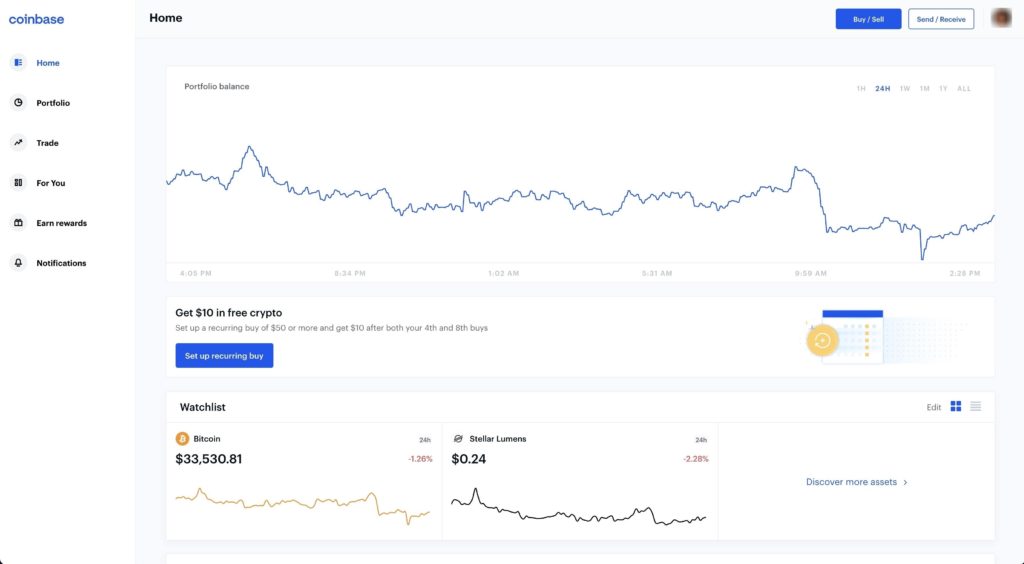

Before you get started and buy anything, you first need to verify your identity. When everything’s been verified, you’ll land on your home page:

Here, the first thing you’ll see is your entire portfolio balance. You’ll also be able to see the 24-hour price of cryptocurrencies you’re following, as well as a breakdown of your portfolio by crypto. But before you can buy anything, you’ll need to link your bank account or credit card.

Linking A Bank Account or Debit/Credit Card

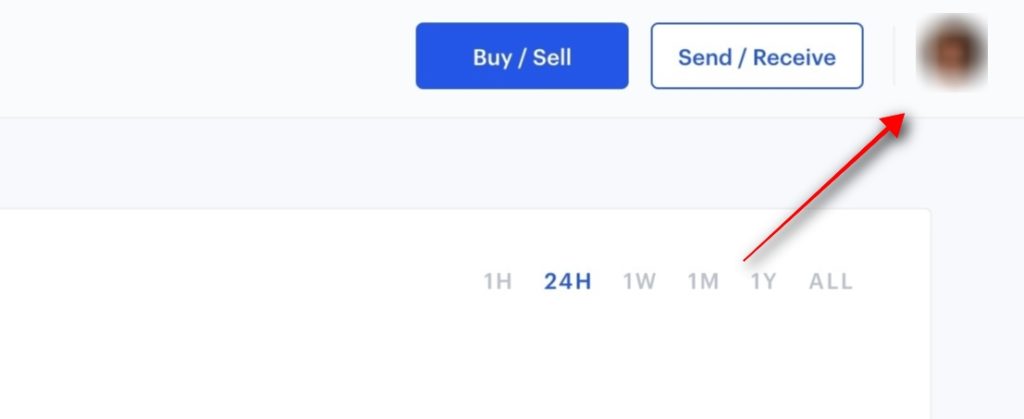

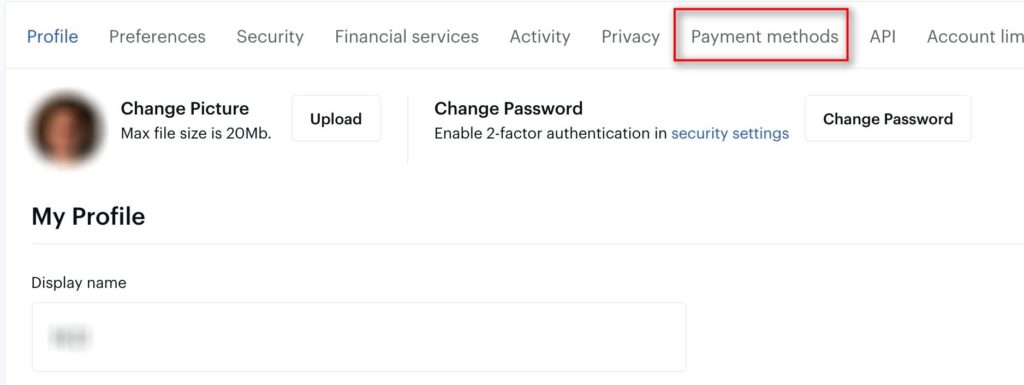

Click your profile picture in the upper-right.

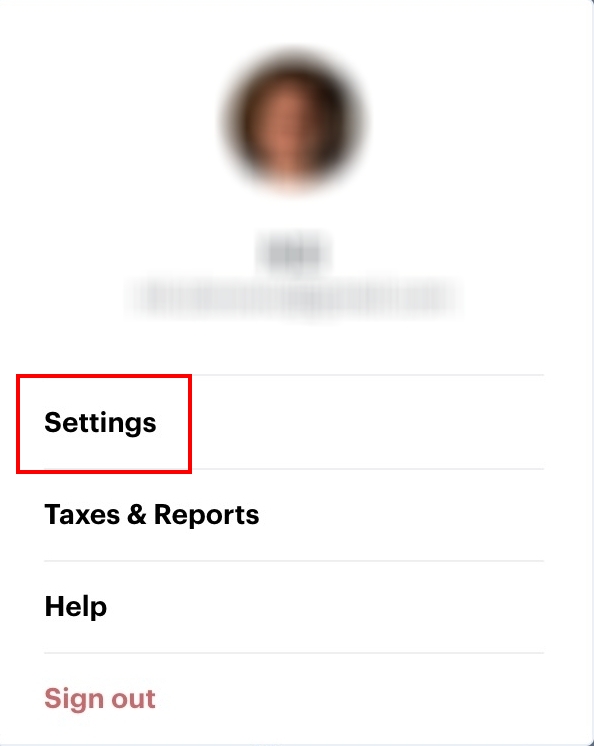

Click Settings in the popup.

Click Payment Methods on the next screen.

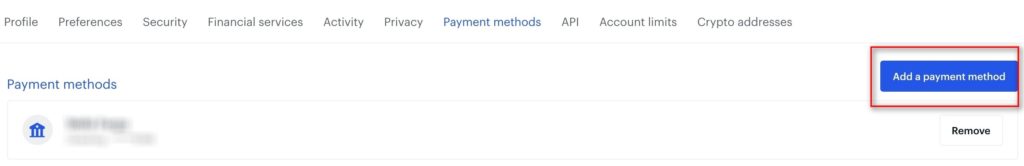

If you haven’t set up any banks yet, you won’t see any yet, so just click the Add a payment method button.

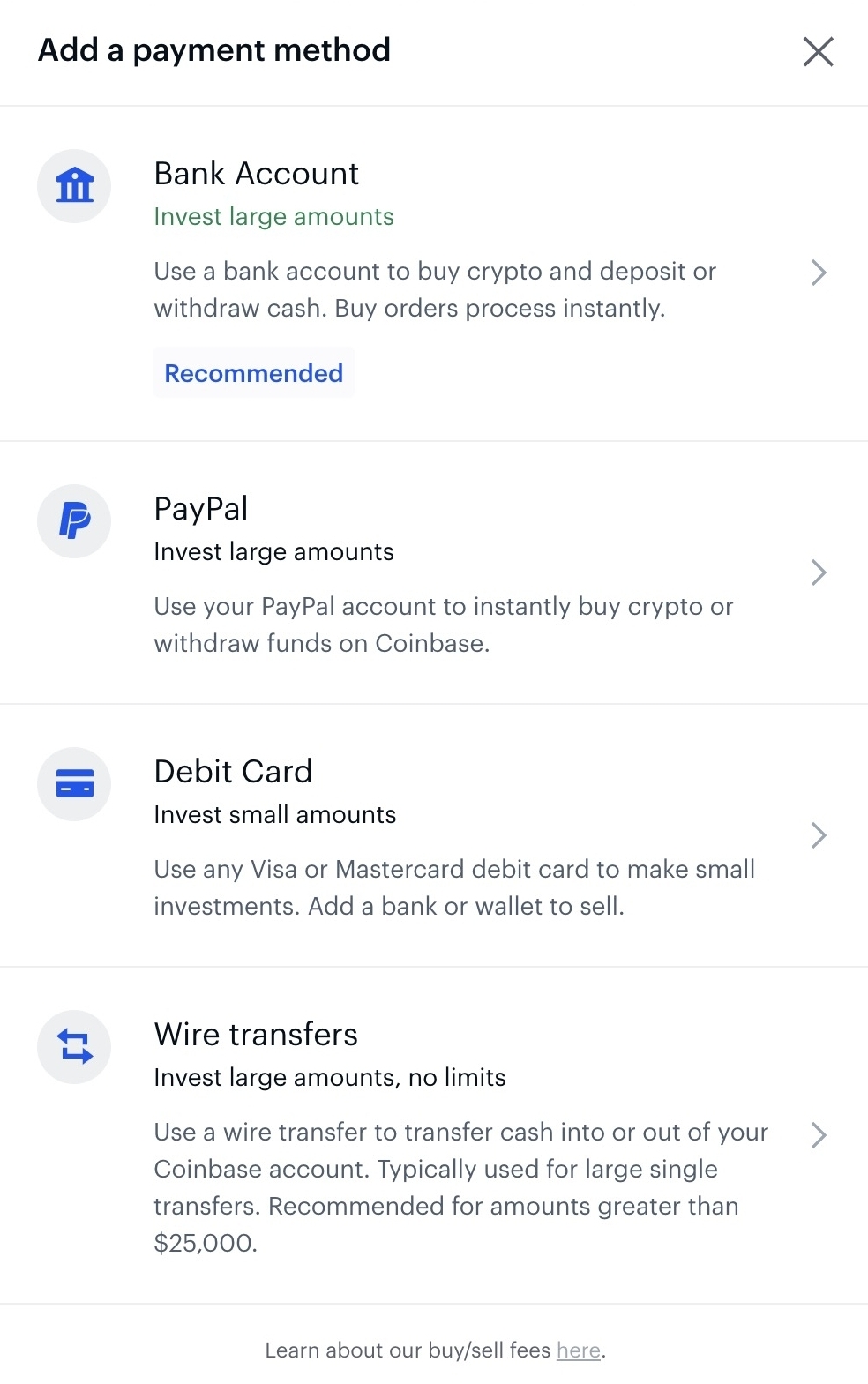

A popup like this will appear:

You can use your bank account, debit card, PayPal, or wire transfer.

In order for Coinbase to verify that you’re actually using an authorized account, they’ll do two small verification transactions (under $1 each). This may be instant if you used your card, or it may take a couple of days for your bank account, but if you have online banking, they will generally show up under pending transactions.

Note: Your bank or credit card may deny your transaction from Coinbase initially and place a freeze on your account. It’s a toss-up. Before you proceed to buy anything, I’d recommend calling them up and letting them know that you’ll be making a purchase on Coinbase with that bank account or card. Save yourself that headache of a canceled transaction.

Buying Cryptocurrency on Coinbase

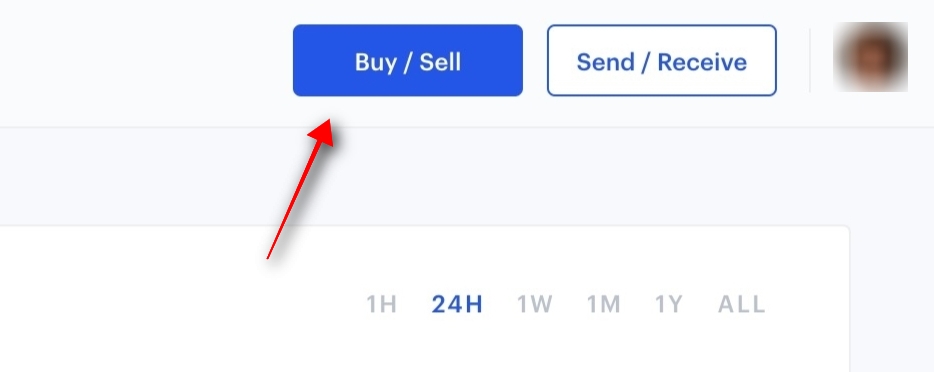

To buy, click the Buy/Sell button at the top of your menu.

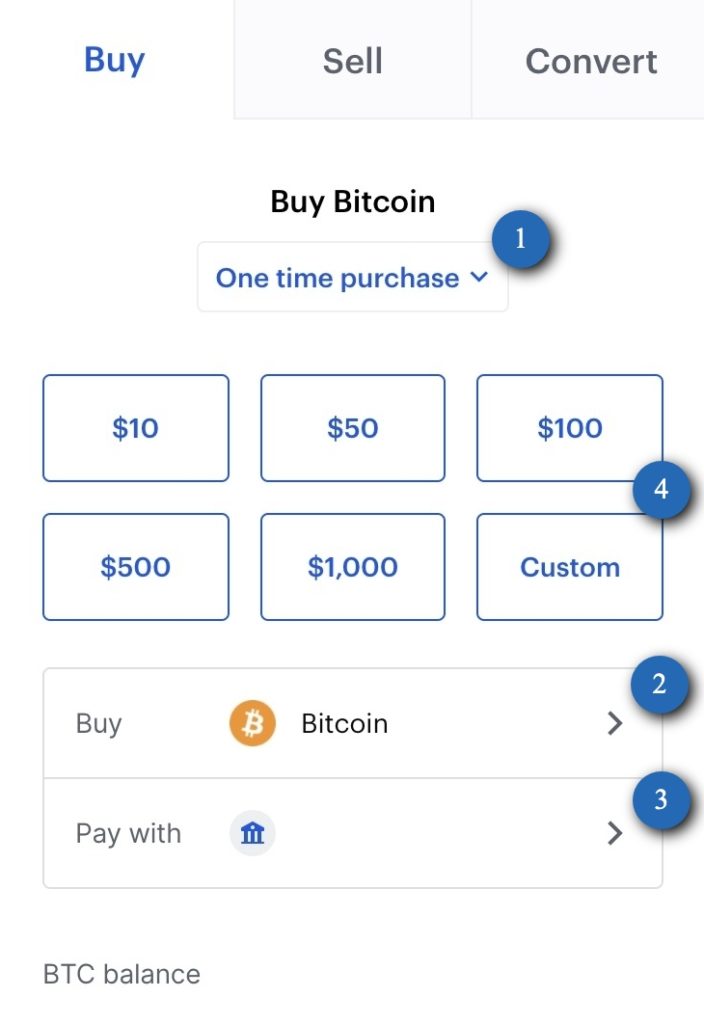

First, choose if this is a one-time or recurring purchase.Second, select which cryptocurrency you want to buy. Third, select your payment method. Fourth, you can type in the amount in USD you’d like to purchase, or you can select an amount from the list.

Note: You can buy in fractions, and DO NOT need to purchase a whole Bitcoin, Ethereum, Litecoin, etc. You can buy 0.005 of a Bitcoin if you so choose to.

If you’ve got 2-factor authentication on, you will need to verify before you can purchase it.

Selling Your Cryptocurrency on Coinbase

With your bank account or Paypal account linked, you can sell as much cryptocurrency as your weekly withdrawal limit allows.

Remember the Buy/Sell button? Click there.

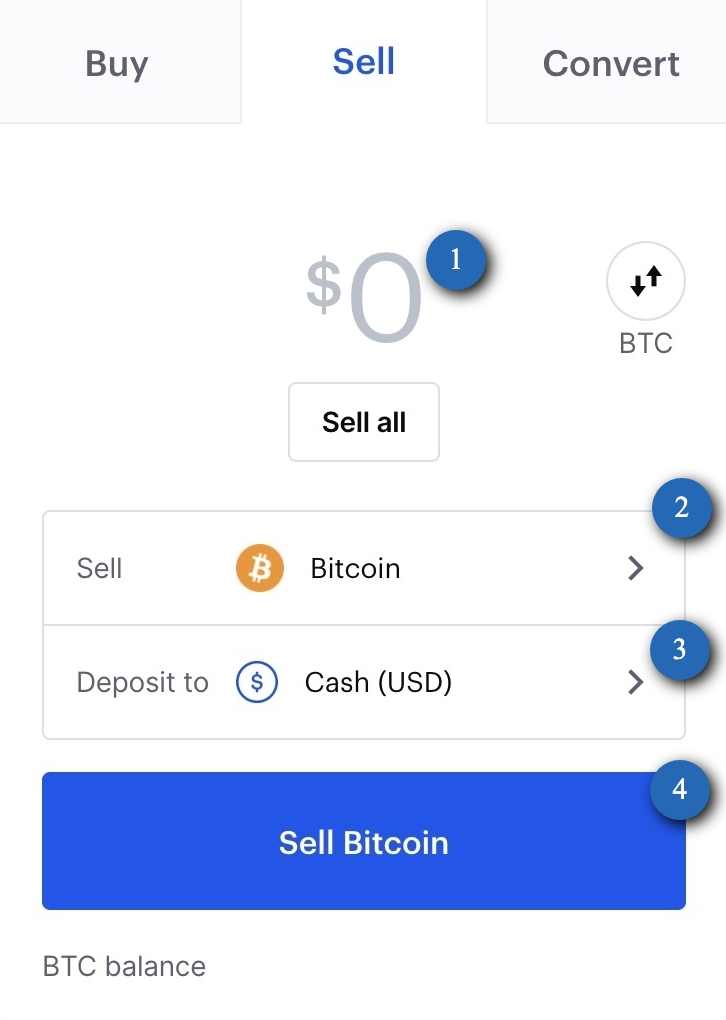

In Buy/Sell, click the “Sell Tab”. First, type. in the dollar amount you want to sell or click sell all. You can also choose the amount in the crypto you’re selling. Second, select the crypto you’re selling. Then select where you’re depositing it to. Finally, click that blue button, and sell!

Alternative Ways To Buy and Sell Cryptocurrency

Coinbase is the most popular and simplest way to purchase cryptocurrency with USD (United States Dollar), but there are alternative methods as well.

Changelly

One of the simplest ways to buy alternative cryptocurrencies with USD is with Changelly. You can also purchase alternative cryptocurrencies using your own cryptocurrencies you’ve already accumulated.

Make sure though that you have a proper wallet that will support the cryptocurrency you’re looking to buy. They’ll require it upon checkout.

Gemini

They have been around for a while. While I haven’t personally used them, I know that they are a popular service similar to Coinbase.

Binance.US

Binance.US is one of the largest exchanges out there with one of the greatest selections of markets. It’s one of the more simple exchanges to use. (Note to those in the United States – you can only use binance.us – not binance.com)

Bittrex

Bittrex is another large exchange that I use frequently. Make sure to verify yourself, otherwise, you will not be able to withdraw.

Kucoin

Kucoin is one of the first exchanges that I used, and one that’s easy to use as well.

There are dozens of other exchanges – I only listed a few trusted ones that I use. Do your research on CoinMarketCap and see what coins are listed on your exchange of choice.

Note: Some exchanges such as Binance (the original, not Binance.US) do not allow people from the United States to sign up and have an account.

Sending And Receiving Your Cryptocurrency

Every wallet and exchange has a different setup, so it would be extremely time-consuming for me to get into all of them. If you need step by step on each wallet or exchange, they should have an FAQ section. I’ll show you how to send and receive in both Coinbase and Binance.US.

Sending and Receiving in Coinbase

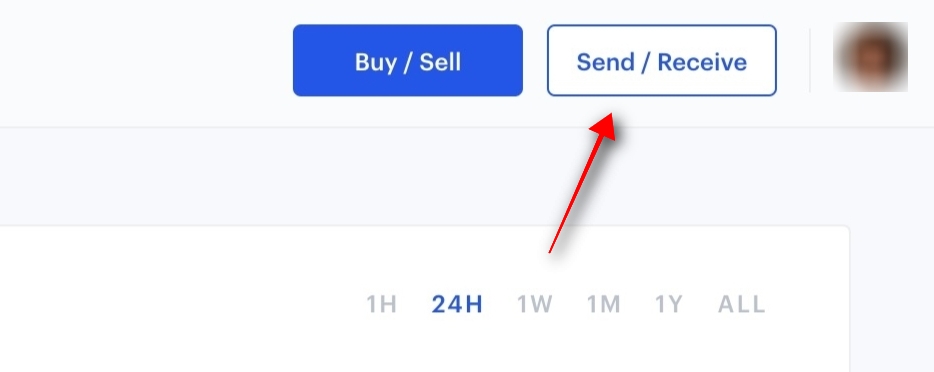

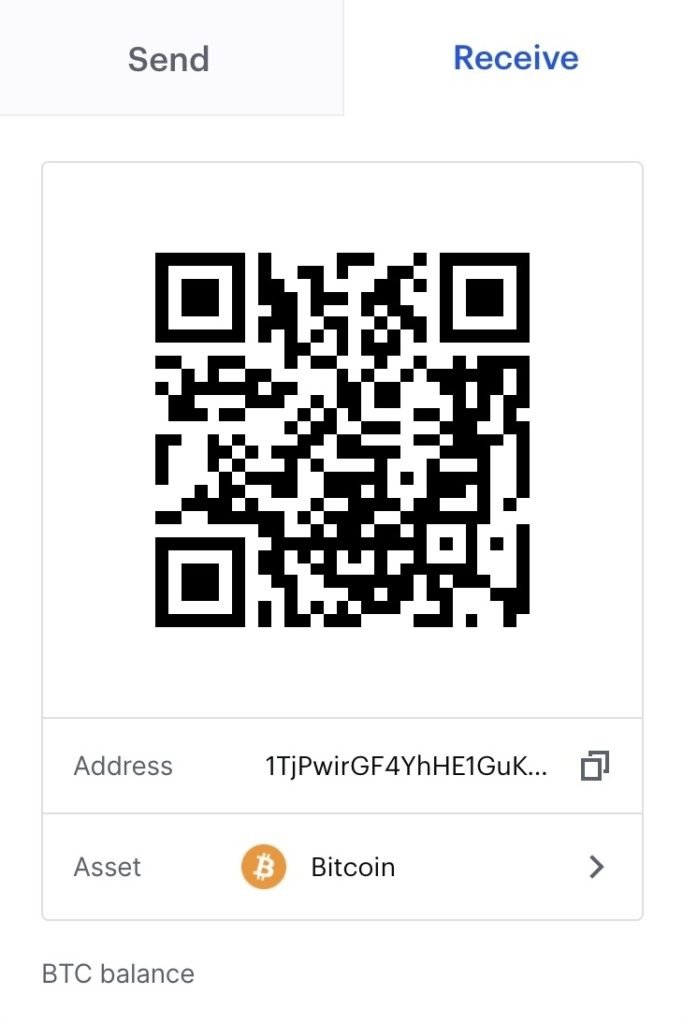

Click the Send/Receive button on your Coinbase home screen.

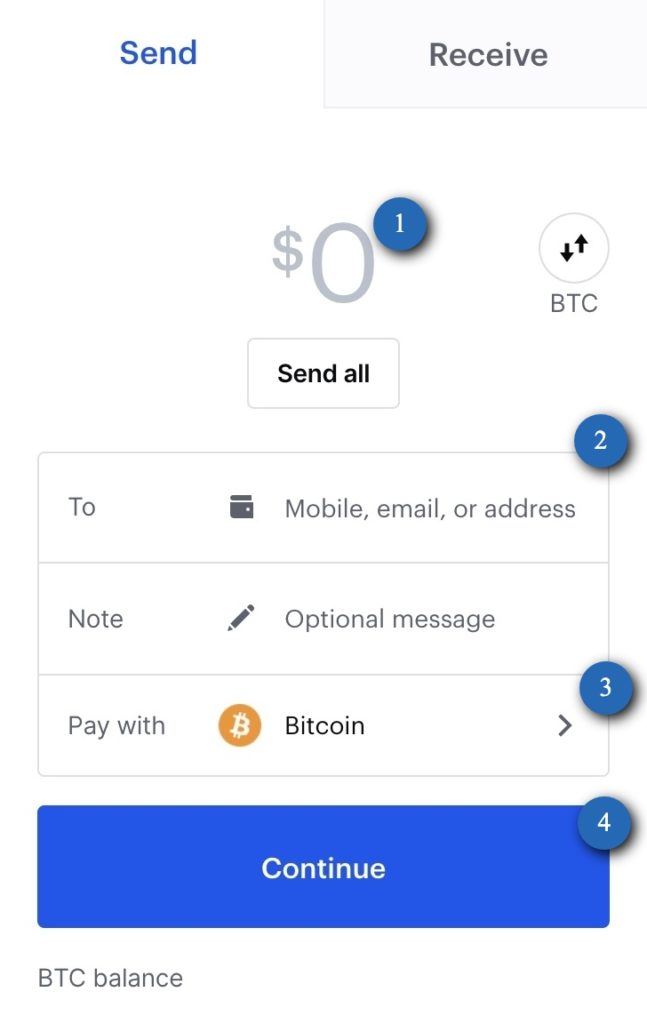

To send, click the Send tab and make sure you have the correct address to send to. Input the amount you want to send in USD or the amount you want to send in the respective cryptocurrency. To get the address someone can send you some cryptocurrency at, click the receive button. You can get the address, as well as a QR code, that you can receive cryptocurrency at. Make sure you’re only sending Bitcoin to a Bitcoin address, Ethereum to an Ethereum address, etc. If you make a misstep on that, your money could be gone forever. Finally, click the blue Continue button to send!

Note: Copy and paste the address you’re sending to. Double-check after you’ve pasted it to make sure it’s correct. Triple check, slowly. If one thing’s wrong, your money could be gone forever.

Another note: Sometimes, sending and receiving can take a while. In some cases, Bitcoin has been known to take a day to transfer. Ethereum tends to be quicker, but with its rise in popularity, it’s seen some network congestion. Don’t freak out if it takes a while. You’ll get notifications from both Coinbase and some exchanges like Binance.US when it’s been received and sent successfully.

In order to receive crypto into your Coinbase wallet, you can copy and paste your address or someone can scan your QR code if they’re nearby.

Storing Your Cryptocurrency

There are a few ways to store your cryptocurrency. Some secure, others, not quite:

Hot Wallets

Hot wallets are the cryptocurrency wallets that you utilize in your online exchanges such as Coinbase, Binance.US, or Bittrex. They’re very convenient because you don’t have to worry about downloading a wallet application or spending money on a hardware wallet. As convenient as they may be, they come with a couple of huge flaws.

If you have a secure password and 2-factor authentication enabled, you’re still not safe. The main concern is hackers. If they compromise the information stored within the exchanges, they could potentially have access to everyone’s money.

Secondly, you do not own your private keys on the exchanges. Unlike a cold wallet such as a hardware wallet or a paper wallet, the hot wallet’s private keys are owned by the exchange.

Don’t store large amounts on the exchanges. Keep some there if you want to make trades or if your cryptocurrency of choice doesn’t have a good wallet yet (I’m looking at you IOTA.)

Software Wallets

This is a type of “hot wallet” that sits on your hard drive. An example of a software wallet is Exodus. This wallet supports cryptocurrencies such as Bitcoin, Dash, Augur, Ethereum, and Litecoin.

Most software wallets allow you to export and download your private keys. The major security flaw of these is potential hackers, and they can fall victim to viruses. If you’re going to use a software wallet, make sure it’s on a dedicated computer that’s only used for cryptocurrency to minimize the risk of any cyber-attacks.

This brings us to our cold wallet, and thus most secure, options…

Paper Wallets

Paper wallets are exactly what you would think they are. They contain your private and public keys. This has the advantage of not being on your computer and thus not being susceptible to hacking.

The main disadvantage to this method is that just like all paper, it’s very fragile. If you get it outside into the rain, you leave it out in the sun, it catches fire, or a wind gust catches it, your wallet is gone forever (unless you made a backup or two). Use proper care, and store your paper wallet in a fireproof safe for safekeeping, or a safety deposit box at your bank.

Hardware Wallets

Hardware wallets are the most secure type of cold wallet out there. The awesome thing about a hardware wallet is that it essentially acts as a key. Your coins and tokens are NOT stored on the device itself. This means that if you lost your hardware wallet, dropped it in the pool, ran over it, or got it stolen, all would be safe if you had the respective recovery seeds to restore it, which we’ll get into in a moment.

Your best (and most budget-friendly) options are the Ledger Nano S and the Ledger Nano X. I highly recommend the Ledger Nano S, for the simple fact that it allows you to store all the major cryptocurrencies, as well as a lot of the up-and-coming alternative coins on them as well. It’s also very budget-conscious.

Get a Ledger Hardware Wallet

Protect yourself with a hardware wallet. I recommend Ledger because they’re the simplest to use, in my opinion.

What makes a hardware wallet so secure? On the Ledger, you are given a random list of 24 words in a specific order. With your hardware wallet, you’ll get a sheet of paper where you can write them down in order. These are not generated on your computer and will be generated directly on your advice. So even if your computer was compromised, your recovery seed would be safe.

You’ll be required to create a pin, and you also have the option of an optional passphrase, which adds an extra layer of security. For the long-term holder, you need a hardware wallet. Not only are they easy to use, but they’re also about as secure as you can get.

Security

Keep Sensitive Information Offline

This should go without saying, but you should keep all your sensitive information offline. Keep your wallet recovery seeds written down on paper (or engraved in steel, if you wanted to go that far) for maximum security. The reason being – if your computer or account is compromised, you won’t have a digital record of any of it.

2-Factor Authentication

2-factor authentication (2FA), in a nutshell, provides an extra layer of security on your accounts by means of you manually verifying that you’re actually the one logging in.

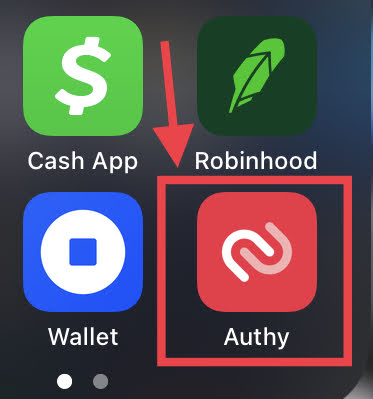

There are two ways you can apply 2FA on your accounts (of course, depending on what option the site allows):

- Via SMS. You’ll receive text messages to your phone number when you try logging in or making a transaction.

- Via an authenticator application. Most exchanges and applications allow Authy. Keep the information handy that exchanges give you upfront to being able to disable 2FA, because you’re out of luck if you lose or break your phone. Your old phone’s authentication will not work on your new phone unless you set up 2FA again.

2-factor authentication is a must, and an authenticator app like Authy is the most secure.

Doing Your Research

In a professional capacity, I won’t suggest what you should and shouldn’t buy. I’m not a financial advisor, and I don’t plan to be.

I’m also biased because I have a diversified portfolio that deals with a few different companies, coins, and technologies.

Do not listen to one person’s recommendations or fall into propaganda or “shilling” (more on shilling in the Terminology You Should Know section). Doing your own research is crucial to making sound decisions and investments. With hundreds (if not over a thousand) viable options to invest in, how do you go about effectively doing research? Well, here are a few suggestions.

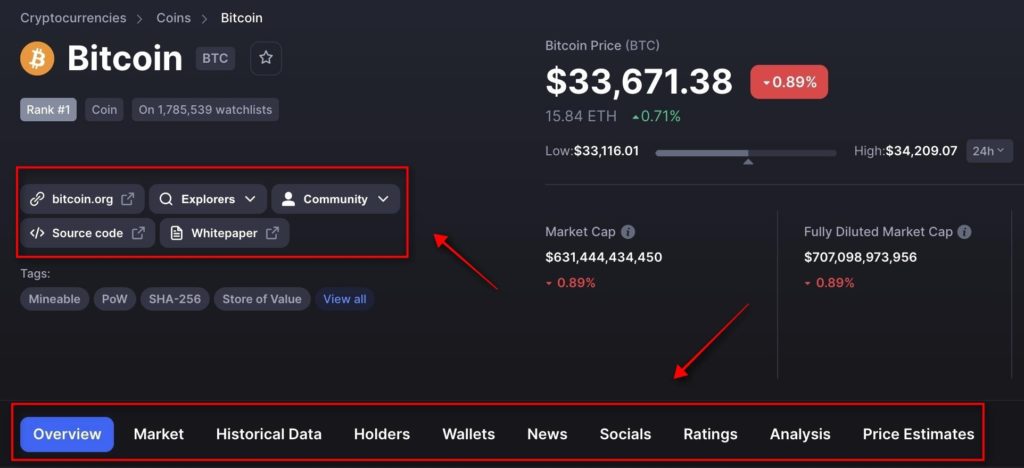

CoinMarketCap

CoinMarketCap will be your cryptocurrency go-to for just about everything. Here, you can see the market capitalization, the current price, the circulating supply, total supply, and historical charts with prices relative to USD, BTC (Bitcoin), and ETH (Ethereum).

The Company’s Website

This is ground zero for all your research, and where you’ll be able to get information such as their whitepaper. Your safest bet is going to CoinMarketCap, selecting your coin of choice, and browsing through the various sections on their page. It’s really come a long way since I got into crypto.

Forums

Forums such as BitcoinTalk are not just about Bitcoin anymore. You can find a fair amount of valuable information here.

A great place to start would be the CryptoCurrency subreddit as they talk about all cryptocurrencies. There’s some comedy such as memes, but you can find a lot of questions, ask your own questions, and contribute to some very focused discussions.

Social Media

Via CoinMarketCap, you can find some of your favorite coins’ Twitter accounts and follow them. You can also find great groups of like-minded folks on Facebook groups where people discuss trading strategies, price predictions, etc.

LinkedIn is also a very good social media network to connect with people investing in cryptocurrencies as well.

Mining

For most average people, buying and building a computer setup with large clock speeds and the best GPU on the market isn’t too economical. It uses a lot of energy and can be too complicating to set up.

Mining rewards get more and more sparse as time goes on, as is the case with Bitcoin. With an expensive rig and lots of energy spent, it can take over a month to mine just one Bitcoin. Hardly worth it for Bitcoin, but much more attainable with other coins.

However, if you are determined to take part in mining for cryptocurrencies as opposed to outright purchasing them, consider a cloud mining service such as Genesis Mining. You pay a one-time fee and slowly earn your desired cryptocurrency over two years (or whatever the contractual agreement could be.) I only can recommend this if you feel that the cryptocurrency’s value will go up a lot in that time frame. Otherwise, it could just end up being a slow way to gain over the course of two years instead of buying upfront and realizing those gains in that same time frame.

Terminology You Should Know

When doing your research, you’ll see so much terminology thrown around that you’ve never seen before. Once you learn what they mean, you’ll get used to the terminology, and it’ll make your research easier and more enjoyable.

Crypto

This simply refers to cryptocurrencies or the cryptocurrency market, depending on the context.

Fiat

Currency issued by a government, such as the US Dollar, the Euro, or Pounds.

ATH

All-time high. The highest price the coin/token has ever achieved.

HODL

Simply means “hold”. It was misspelled on a forum years back. Some will say that it means “hold on for dear life,” which works as well.

Shill

This is when a person or company acts in their own self-interests and promotes a coin, token, or project wholeheartedly. They focus only on the positive and tend to ignore or downplay any negative concerns.

FOMO

Fear of missing out. People will see uptrends in the charts, lots of volume being traded, or news and don’t want to miss out on making gains. This can sometimes work for or against people and can result in panic buys, thus causing a temporary spike up in cryptocurrency prices.

FUD

Fear, uncertainty, and doubt. This is essentially the opposite of “shilling” and causes a lot of negative feelings towards a coin, token, or project. This can cause dips or crashes in prices.

To The Moon / Mooning

When someone says “to the moon!” they generally mean that the price is going to shoot way up. Same thing with “mooning” – If the price has spiked significantly, you can refer to that level as mooning.

Bull / Bullish

Just like in stock market terminology, a bull run, bullish market, or bullish trend is when prices are going very well. It can also refer to the future expectation that prices will increase.

Bear / Bearish

The opposite of bull / bullish. A bear market or bear trend is when prices are not going well and can refer to the future expectation that prices will decrease.

ICO

Initial coin offering. Just like a company’s IPO (initial public offering), this allows people to get people in on investing in a coin or token before it’s released to the mass public via exchanges.

Market Cap

Circulating supply of the coin or token multiplied by its current price.

Tips

I’ve made many good decisions since first investing in cryptocurrencies, but I’ve also made mistakes. I’ve also heard of a lot of other people making mistakes. The entire point of this guide was to make it easier for you, and for you to minimize your mistakes. If I save one person the headache of having to figure something out where there was no simple source, I’ll have considered this guide a success. So, to end this guide, I want to offer some final tips.

Never invest more than you’re willing to lose

Do not bet the money you’re counting on to pay rent. Do not take your life savings and dump it into cryptocurrency. Of course, things could work in your favor. But it’s certainly not worth the headache you’d be causing yourself by having to stress about crucial money and whether or not you’ll lose money.

Take a break here and there

Yes, it can be very exciting to see your portfolio tracker go higher and higher, but don’t make it your life’s mission to check every fifteen minutes. Unless you’re a day trader, it’s not healthy to check in all the time. Instead, check your portfolio a few times a day or less, and you’ll be able to sleep better.

Stay Humble

Lastly, stay humble. We’re all in this together. We have all invested different amounts, believe in different technology that’ll change the world, and diversified our portfolio differently. We all started somewhere.

Share your excitement about the market as a whole going well, or a particular coin you decided to invest in just skyrocketing, but don’t brag.

Help people when you can with any knowledge you may have picked up along the way. Pay it forward.

For people who didn’t know how to get started, I hope this helped you. If I helped, please consider clicking the links in the article and signing up for accounts that way. A few are affiliate links that will give me a little something when you sign up and purchase something. I wouldn’t recommend a site or product without actually using it myself, and I use these all the time.

Get Free Bitcoin

Sign up through Coinbase using the button below and get $10 USD equivalent of Bitcoin if you spend at least $100 on buying cryptocurrency within 180 days (and I’ll get the same!) It costs you nothing.